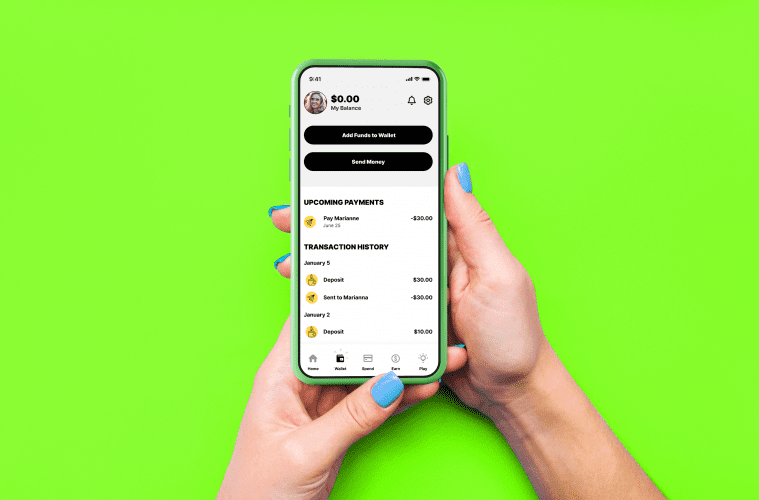

Mydoh is an interactive, hands-on, money management app that allows parents to teach their kids sustainable and basic money skills, as well as manage their chores, through a gamified platform.

Kids learn money basics through Mydoh Play – budgeting, saving, investing and track their spending, earnings and balance. Parents can set tasks, manage allowances, send money to their children through the app and even engage with them using emojis.

Using the Smart Cash Card provided (available physically and digitally), kids can even make purchases with the money they have earned.

Gaurav Kapoor is the CEO and co-founder of Mydoh. In 2016, Gaurav built his first product in personal money management for adults but noticed a foundational gap in youth financial literacy. Gaurav’s expertise and experience in building money management solutions helped lead to the development of Mydoh at RBC Ventures, an internal incubator within Canada’s largest financial institution. He and his team at Mydoh are helping parents raise money-smart kids.

Gaurav Kapoor Gives Tips To Have Better Spending Habits This Year

How can someone who has never had the habit of saving begin in this new year?

Most of us feel like we should always be saving “more”, but we forget that saving is just like any other habit – it requires consistency, team support and a goal.

No matter your age, or financial chops, it is important to start by setting a goal because it can motivate you to achieve your objectives. To develop your goals, which will trigger good money habits, everyone should become comfortable talking about money.

If we don’t talk about money, money can start to feel like something mysterious, shameful, or even scary – for ourselves and everyone else in our unit, whether that is a partner, sibling and/or kids. However, once money becomes a part of the family conversations, it’s easier to set and define short (i.e. buying an ice cream cone or saving for fun hangout with friends)– and long-term (i.e. buying a new pair of shoes or phone) goals, and for the right habits to form. Bringing you one step closer to making your goals a reality.

What should financial goals look like and how should they be established for them to be achievable?

Financial goals are really just short-term and long-term measurable milestones. Essentially, they are the difference between a wish and a plan! You’ve likely heard of establishing SMART goals – Specific, Measurable, Achievable, Realistic and Timely – and this works with saving too. For example, you’re looking to buy the newest phone:

- Specific – Rather than saying, “I would like to buy it”, identify the specific area of your finances (like increasing your paycheque savings by 10% each month) that would help to purchase the phone.

- Measurable – We did that above! Increase that saving by 10% per month and see your growth over time!

- Achievable – Goals need to challenge you, yet be specific enough that you can actually achieve them. So, while 10% could be an end goal, 5% might be better to start with, and more realistic.

- Realistic – Achievable and realistic go hand-in-hand because they will keep you motivated, and on track to your goals.

- Timely – Setting a deadline like “I will buy this new phone by my birthday” will keep you organized, accountable, and if things change, the timelines can be adjusted to still help you meet your goals.

Finances can get overwhelming, quickly. The SMART method simply makes sure that that doesn’t happen and keeps you on track to meet your goals.

What is the best way to create a budget that’s easy to stick with and not get overwhelmed?

Like I mentioned, finances are best managed collaboratively (discussed). This is why at Mydoh we will always encourage parents and kids to talk about their money and budgets.

To help you stick with it the five basic components are:

- Calculate your income – paycheques, tax returns, tips, gifts and allowances

- Identify your fixed and variable costs – separate fixed (same month over month) and variable (might change month over month) into two separate categories and take a moment to think which costs are needs versus wants, by asking yourself “is this something I can live without?”

- Set up a savings goal – decide how much of your income you would like to save each month. You can also break it down further into short and long-term goals.

- Determine how much income should go to needs, wants and savings – a popular method is the 50/30/20 rule, where 50% of your income goes to needs, 30% to wants and 20% to savings.

- Decide on budget categories – these should be based on your unique needs but some of them can include savings, clothing, bills, activities etc.

Published by HOLR Magazine