Medline’s IPO highlights strong investor demand for the medical supply business, a traditionally quiet but stable corner of healthcare

A Strong IPO From an Unexpected Corner

December 17, 2025: Medline’s initial public offering has drawn significant attention, underscoring strong investor appetite for a traditionally low-profile segment of the healthcare industry. Long viewed as a steady but unexciting business, medical supply distribution is now emerging as an attractive investment opportunity.

Image Credit: Reuters

Why Medline’s IPO Matters

Medline operates in a part of healthcare that rarely grabs headlines—supplying hospitals, clinics, and care facilities with essential products. Yet the company’s IPO performance suggests investors are increasingly valuing stability, scale, and predictable demand over flashier but riskier healthcare bets.

The offering highlights how “boring” businesses can still deliver compelling growth stories.

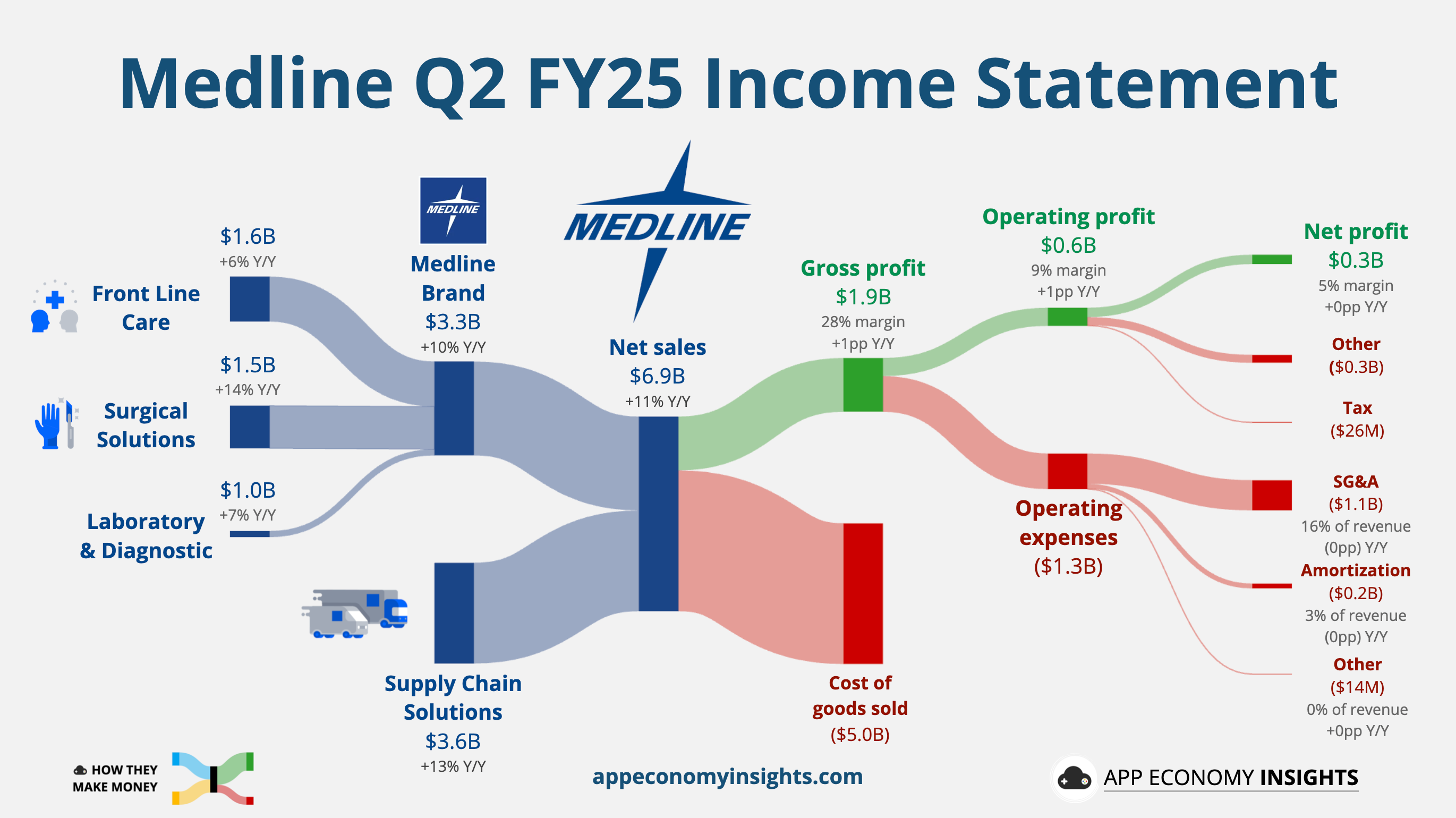

Image Credit: App Economy Insight

A Shift Toward Reliability and Cash Flow

In a market shaped by volatility and higher interest rates, investors have shown renewed interest in companies with dependable revenue streams. Medline’s business model benefits from long-term contracts, recurring demand, and deep integration into the healthcare system—qualities that are increasingly prized.

Rather than betting on breakthrough drugs or experimental technologies, investors appear more willing to back companies that quietly keep the system running.

Image Credit: Kiplinger

Healthcare’s Defensive Appeal

Healthcare has long been viewed as a defensive sector, but Medline’s IPO suggests a deeper trend. Investors are not just seeking safety—they’re looking for businesses with strong margins, operational efficiency, and room for gradual expansion.

Medical supplies may lack glamour, but they remain essential regardless of economic conditions.

What This Signals for the Market

Medline’s debut could open the door for similar companies in overlooked healthcare niches to consider going public. The success of the IPO sends a message that investor demand extends beyond innovation-driven stories to include operational excellence and scale.

It also reflects a broader recalibration of what makes a company attractive in today’s market.

Image Credit: ET Pharma

Looking Ahead

As healthcare costs rise and systems seek efficiency, suppliers like Medline are positioned to play an even larger role. If investor enthusiasm holds, the IPO may mark a turning point for how Wall Street views this once-sleepy corner of the healthcare business.

For now, Medline’s public debut stands as a reminder that in uncertain times, steady businesses can shine.

Published by HOLR Magazine