Analysts expect steady—but limited—growth as Sirius XM balances cash flow strength with industry challenges

January 8, 2026: Predicting where a stock will land three years from now is never exact, but current trends offer insight into what investors might expect from Sirius XM Holdings Inc. as it looks toward the end of the decade.

Rather than explosive growth, most market observers anticipate gradual and measured performance, driven by stable cash flow, disciplined cost management, and a loyal—though maturing—subscriber base.

A Business Built on Stability

Sirius XM continues to operate in a niche space within the audio and entertainment market. Its satellite radio platform provides recurring revenue and relatively predictable subscription income, which has helped the company weather shifts in consumer media habits.

However, subscriber growth has slowed, and much of the company’s focus is now on retention and monetization rather than rapid expansion. That dynamic shapes expectations for the stock’s future trajectory.

Image Credit: AOL.com

Earnings and Revenue Outlook

Looking ahead three years, earnings are expected to grow modestly as the company tightens expenses and optimizes operations. Revenue growth, however, is projected to remain limited, reflecting competitive pressure from streaming platforms and podcasts that offer low-cost or free alternatives.

This combination—flat to modest revenue paired with incremental earnings improvement—suggests Sirius XM’s stock may edge higher rather than surge dramatically.

Where the Stock Could Trade

Based on current valuation models and analyst sentiment, many market watchers believe Sirius XM shares could trade somewhat higher than today’s levels within three years, assuming no major disruption to its business model.

That upside, however, is likely to be measured, not transformative. The stock is generally viewed as a stability play rather than a high-growth opportunity.

Image Credit: AOL.com

Cash Flow Remains a Key Strength

One of Sirius XM’s biggest advantages is its strong free cash flow, which supports dividends, debt management, and ongoing investment in content and technology. For income-focused investors, that reliability remains a major draw.

As long as cash flow remains resilient, the company is positioned to maintain shareholder returns even in a slower-growth environment.

Risks to Watch

Despite its stability, Sirius XM faces clear risks that could weigh on performance:

shifting consumer audio habits

competition from on-demand streaming

pressure on auto sales, which affect new subscriptions

long-term debt obligations

Any acceleration in subscriber losses or margin compression could limit upside potential over the next three years.

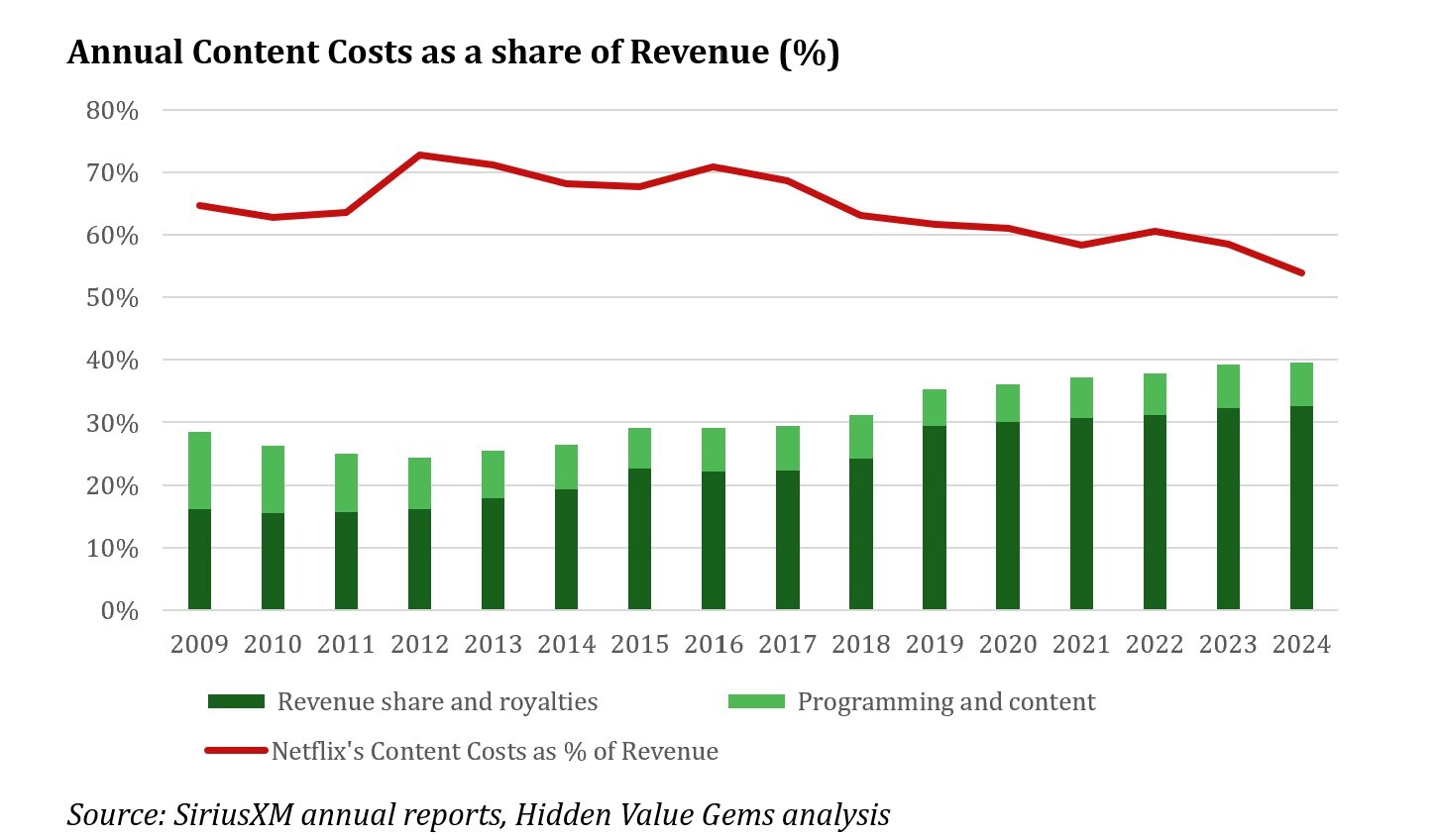

Image Credit: Hidden Value Gems

Investor Sentiment and Long-Term Appeal

Sirius XM tends to attract investors looking for predictable returns rather than rapid appreciation. Its appeal lies in consistency, not disruption. That profile may keep volatility lower—but also caps how high the stock can climb.

For long-term holders, the company’s focus on operational efficiency and cash generation could continue to support a stable share price with incremental gains.

Outlook

Over the next three years, Sirius XM stock is more likely to experience slow, steady movement upward rather than dramatic swings. Investors should expect modest appreciation supported by cash flow and disciplined management, balanced against ongoing industry headwinds.

For those prioritizing stability and income, Sirius XM may remain a reasonable long-term hold. For growth-focused investors, expectations should stay grounded.

Published by HOLR Magazine