Toronto and the Greater Toronto Area are experiencing major real estate growth in 2026, with high-rise construction, rental expansion, transit investment, and skyline transformation driving demand.

February 19, 2026: Toronto and the Greater Toronto Area (GTA) are undergoing one of the most significant real estate expansions in Canada, with 2026 marking a pivotal year in large-scale development, skyline transformation, and structural housing shifts. Despite moderated pricing compared to prior peak years, construction momentum across the region signals long-term confidence in Toronto’s economic strength and population growth trajectory. HOLR has the latest news on how this building surge is reshaping the region and what it means for buyers, investors, and communities.

A Skyline Defined by Cranes

The skyline of Toronto remains dominated by cranes as multi-billion-dollar projects continue advancing. Among the most notable developments is Pinnacle One Yonge, a transformative waterfront project featuring multiple towers, including one set to become the tallest residential building in Canada. The scale of this development reflects a broader shift toward mixed-use vertical communities combining residential, commercial, retail, and public space.

Similarly, One Bloor West is rising as one of the country’s tallest skyscrapers, redefining the luxury condominium segment in the Yorkville district. These landmark towers are not isolated developments; they represent a wider appetite for density in high-demand urban corridors.

HOLR breaks down the pattern: while short-term price fluctuations occur, large-scale capital investment continues flowing into long-term vertical construction.

Image Credit; Doane Grant Thornton LLP

Growth Beyond Downtown Toronto

Real estate expansion is not confined to the downtown core. The broader Greater Toronto Area is experiencing rapid intensification. Suburban municipalities such as Vaughan, Mississauga, Brampton, and Markham are evolving into high-density urban nodes.

Vaughan Metropolitan Centre, for example, has emerged as a secondary skyline cluster with numerous towers exceeding 100 metres. Transit-oriented development is driving this shift, with residential towers strategically positioned near subway and regional rail connections. These projects reduce commute times and attract residents seeking urban convenience outside Toronto’s traditional downtown.

Mississauga continues expanding its City Centre district, while Markham is seeing increased condominium launches tied to employment hubs and tech sector growth. The GTA’s development story in 2026 is one of decentralization paired with connectivity.

Image Credit: blogTO

Purpose-Built Rental Construction on the Rise

One of the most defining real estate trends of 2026 is the expansion of purpose-built rental housing. As affordability challenges persist, developers are pivoting toward long-term rental supply to meet strong tenant demand.

Mid-rise and high-rise rental buildings are under construction across North York, Scarborough, Etobicoke, and outer GTA municipalities. These projects often include modern amenities, coworking spaces, and community-focused designs tailored to younger professionals and immigrant families.

The shift toward rentals represents a structural change in the housing market. For years, condominium units dominated supply growth. In 2026, rental-focused developments are gaining stronger institutional backing, reflecting changing lifestyle preferences and financial realities.

HOLR notes that this pivot helps stabilize housing access while diversifying the real estate ecosystem.

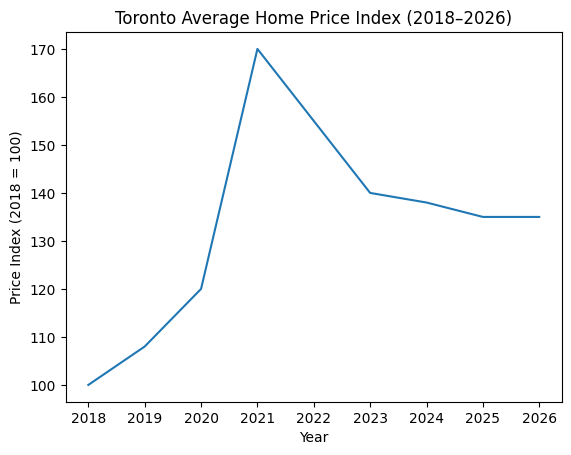

Market Conditions: Stability Over Speculation

While Toronto remains one of Canada’s most valuable housing markets, 2026 has seen moderated pricing compared to the aggressive peaks of earlier years. Average home prices have softened in certain segments, and inventory levels have improved, offering buyers more negotiating power.

However, softer pricing does not signal collapse. Instead, analysts describe the market as recalibrating. Projects already approved and financed continue progressing, particularly those tied to prime transit corridors and mixed-use master plans.

Investors are increasingly focused on long-term appreciation rather than short-term speculation. Pre-construction projects with strong developer backing and transit access remain attractive.

Image Credit: Liberty Village Toronto

Infrastructure Fueling Property Demand

Transit investment remains one of the most powerful drivers of real estate growth in the GTA. Subway extensions, light rail lines, and GO Transit upgrades are improving regional mobility and unlocking development opportunities in previously underutilized zones.

Transit expansions increase land value near stations, incentivizing higher-density construction. Developers are strategically acquiring land near future transit hubs, anticipating rising demand once projects are completed.

Infrastructure confidence signals long-term economic planning — and real estate markets respond accordingly.

Mixed-Use Master-Planned Communities

Developers are increasingly building master-planned communities rather than standalone towers. These projects integrate residential units with retail corridors, office space, public parks, and community services within a unified footprint.

Walkability has become a core selling feature. Residents value the ability to live, work, and socialize within a short radius. This shift reduces reliance on vehicles and aligns with sustainability goals promoted across municipal planning frameworks.

In 2026, Toronto’s real estate boom is not simply about adding height — it is about creating interconnected neighborhoods.

Image Credit: Toronto Life

Sustainability and Smart Design

Environmental considerations are central to modern GTA developments. New projects incorporate energy-efficient building systems, advanced insulation standards, and sustainable materials. Electric vehicle charging infrastructure is becoming standard in parking garages.

Green roofs, improved stormwater management systems, and energy-saving technologies reflect a broader push toward climate-conscious urban expansion. Developers recognize that future buyers and tenants increasingly prioritize sustainability when choosing housing.

HOLR highlights that growth without sustainability is no longer considered viable in large metropolitan planning strategies.

Commercial and Office Sector Adaptation

The commercial real estate sector is also evolving in response to hybrid work models. While some downtown office demand has softened, new Class A buildings with modern ventilation systems and flexible layouts continue attracting tenants.

Suburban office hubs are gaining momentum, particularly in Mississauga and Markham, where companies seek accessible alternatives to traditional downtown headquarters. This diversification strengthens economic resilience and distributes employment nodes more evenly across the GTA.

Image Credit: TorontoToday.ca

Long-Term Outlook: A Structural Urban Transformation

Population projections, immigration targets, and economic diversification continue to underpin Toronto’s real estate growth outlook. Canada’s federal immigration plans contribute to steady housing demand, particularly in metropolitan regions like the GTA.

While affordability challenges remain a pressing issue requiring coordinated policy solutions, the physical evidence of growth is unmistakable. Construction cranes, rising towers, and transit expansions point toward a city still building — not retreating.

HOLR recognizes that the tremendous growth happening in Toronto and the Greater Toronto Area in 2026 is more than a construction story. It represents an urban transformation driven by population momentum, capital investment, and forward-thinking planning.

Toronto is not simply expanding outward — it is building upward, densifying strategically, and reshaping how modern Canadian cities function. The skyline may be the most visible symbol of change, but the deeper transformation lies in infrastructure integration, rental diversification, and community-focused development.

The real estate boom unfolding across Toronto and the GTA signals long-term confidence in Canada’s largest metropolitan economy. As 2026 continues, the region remains one of North America’s most active and closely watched development markets — a city and region very much still in motion.

Published by HOLR Magazine