A new taxation policy was announced to be implemented for rich people in China. With less money available, Chinese citizens will probably decrease their spendings on discretionary goods. As part of a Governmental plan to redistribute wealth in the country, these new taxes will have a direct impact on the Luxury Fashion Industry. But, how bad will the effects be?

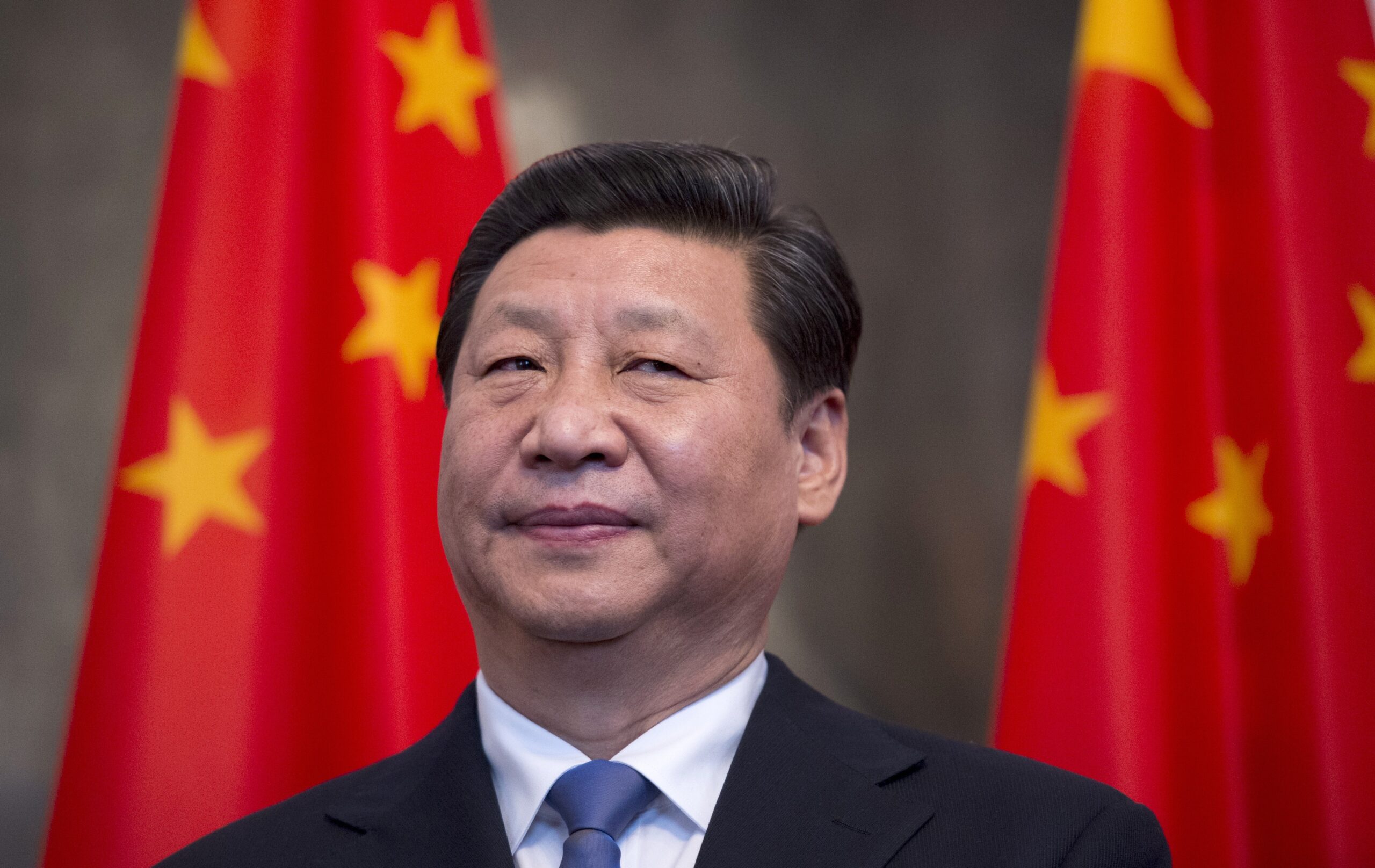

On August 17th, during a Communist Party’s Central Committee for Financial and Economic Affairs meeting, the current Chinese President Xi Jinping announced that, as part of a plan to expand the country’s middle class, an adjustment to excessive-high incomes was going to be set in place. Even if we still don’t know much about what exact actions will be taken, some economists suggest that real estate and inheritance taxes are key points in diminishing social inequality in China. Apparently, this policy was said to be adopted to encourage super-rich people in the country to “return more to society”, as private firms – ranging from education to technology companies – have been responsible for creating several new billionaires almost every week. This raise in tax rates paid by wealthy people directly reflects not only on China’s economy but on the global economy, with its effects hitting a number of industries, including the Luxury Fashion Industry.

It is more likely for this new taxation plan to be implemented gradually, but effects of the Chinese “redistribution of wealth” plan begin to appear: according to the Financial Times, since June this year, the net worth of the two dozen Chinese billionaires in tech and biotechnology combined dropped 16%. Globally speaking, giants in the fashion luxury goods sector were impacted as shares in LVMH fell by more than 5% on the day this new policy was announced, Prada shares fell almost 24% since then, Kering fell about 11%, and Richemont fell around 13%. It means that in a matter of days, luxury companies lost over $70 billion dollars in value. In the luxury business, extra taxation for riches can mean bad news: usually, as people start to feel less rich, they tend to direct less money to discretionary spendings like luxury goods. Consequently, at least in the short-term, the luxury sector performs fewer sales and generates lower profits, because rich people’s willingness to spend money gets damaged by money loss they face with new taxes being imposed on them.

Moreover, in the luxury sector, more than 20% of its sales are tied to the top 1% of spenders. In China, the top 1% of spenders can mean between 100,000 and 1,000,000 people, so the outcome of this new tax policy is huge. It is important to highlight that not all companies would be impacted the same way, as some brands are more appealing to Chinese customers, such as Hermès, for example. Under the same scope, categories like haute couture and high jewelry, for already being a lot more expensive, are also more relevant to very rich consumers.

Photo Credit: FHH Journal

The Covid-19 pandemic has already hit markets with several disruptions, suggesting a top-line growth of only 18% next year, compared to 33% this year. Risks involved in this higher taxation on Chinese wealthy people could result in top-line growth of 0% to -5% or -10% since the market is now near to pricing in 0% growth. The actual consequences of higher taxes for rich Chinese are still a chapter to be uncovered, so we will have to wait and see what happens.

Published by HOLR Magazine.