Are you looking for the perfect place to call home? Arizona might be just what you’re searching for! With an exceptional climate, plenty of outdoor activities, wonderful food, and a robust housing market, it’s no wonder why so many Americans are heading to The Grand Canyon State.

Purchasing a home in Arizona can seem like an intimidating process at first. You have a thousand thoughts about if it is possible to buy a house with a credit card, if is apple card worth it, or if you should just take out a loan.

But don’t worry; we’ve got all the tips and information you need to make buying your dream home much less daunting!

In this blog post, we’ll cover everything from the costs involved with purchasing property in Arizona to helpful tips that will help guide you throughout your search. So if you’re ready to kickstart your journey as a homeowner and learn about life in gorgeous Arizona – read on!

Get to know the local market and the cost of living in Arizona

While vacationing in Arizona, exploring the area markets is a great way to learn more about local customs, culture, and cuisine.

Whether you prefer visiting the open-air stalls of Flagstaff or browsing through the wares at Tucson’s artisanal marketplaces, the local markets of Arizona offer an array of interesting and delicious experiences for everyone.

The cost of living in Arizona varies from one location to another, with Phoenix having a much higher cost than other places in the state. Since prices are influenced by tourism as well as population density, it is important to keep that in mind when traveling here.

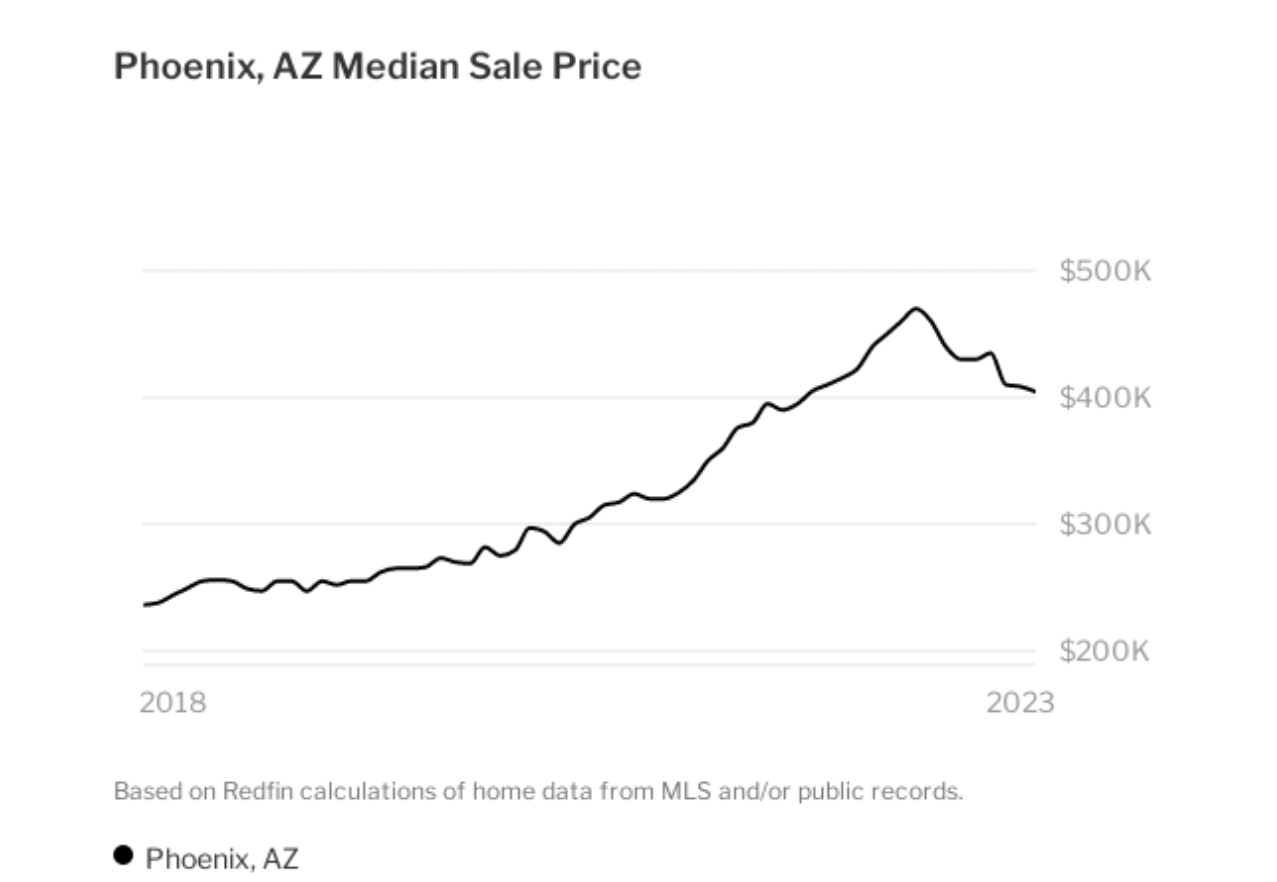

Source: https://redf.in/0N32es

Homeowners in Phoenix saw a 4.3% decrease in the median home price, selling for a value of $404K during January 2023, compared to last year’s rates. Houses are taking an average of 70 days on the market before they can be sold – 32 days longer than this time last year – and only 1,043 homes have been purchased thus far this month, down from 1,837 residences sold in the same period in 2022.

Knowing what to expect and researching beforehand can help make sure you discover unique products while saving money.

Understand what type of loan you will need

Depending on your individual needs, the type of loan you will need to secure a home mortgage can vary. The most commonly used types are conventional, FHA, and VA mortgages.

A conventional mortgage offers traditional financing with no government underwriting or guarantee, meaning that you must meet certain income, debt, and credit criteria to qualify. An FHA loan is backed by the Federal Housing Administration and is meant for those who may not meet conventional loan requirements but can still manage an affordable payment.

Lastly, a VA loan is offered to those who serve in the military or are veterans and offers the lowest possible rates available. It is important to understand which type of mortgage will best suit your situation before making any commitments so you can be confident that you’re getting the right deal.

Determine your budget and what you can afford

Establishing a budget is an important and necessary first step when determining what you can afford. Start by working out your base income and deducting necessary expenses like rent or mortgage, food bills, debt repayments, car loans, or monthly transport fares.

Once these essentials have been deducted from your salary, you’ll be able to gauge how much you’re left with and can then work out if it’s realistic for you to make any other ongoing payments like subscriptions, going out occasionally, or even saving for a rainy day fund.

Finding the right balance between spending and saving takes time, but sticking to a budget will help keep you on track so that responsible financial decisions don’t feel restricted in the long term.

Hire an expert real estate agent

Buying a home is an overwhelming process, but considering the Arizona real estate market, in particular, can add another layer of complexity.

With the multiple pockets of real estate and the ever-shifting housing landscape, having an expert guide you through the process is invaluable.

When considering potential real estate agents from the area, ask pertinent questions to get a clear understanding of their knowledge of Arizona’s market trends and neighborhoods.

Having an experienced realtor who knows the housing climate in your desired location will help alleviate stress, ensuring you find the perfect home in record time that meets both your budgetary needs and desired desirability factors.

Ask questions about the property before making an offer

Before making an offer on a property, it is essential to ask the right questions. Knowing the answers can save you a lot of money down the line and make sure that you are making an informed decision.

Questions should cover various topics such as taxes, zoning information, home inspections, utility costs, and neighborhood safety. Make sure to check on potential proximity to freeways or other noisy sources of transportation to ensure that your purchase of the property in Arizona is secure and comfortable.

You should also pay attention to small details such as odor and the presence or lack thereof of pests while performing initial inspections in the area. Asking the right questions before investing in a property will help you avoid any future surprises and extra costs.

Conclusion

After considering all of these factors, it is time to make a decision when it comes to moving to Arizona. It is essential that you stay mindful of the local market.

The cost of living, understand what type of loan may be best for your individual needs, determine your budget and what you can afford, research different neighborhoods in the area, hire an experienced real estate agent who knows the area well, and lastly, don’t forget to ask questions about the property before making an offer.

Moving can be an exciting time for anyone ready for a new experience or adventure. Still, it is important to do as much research as possible before committing so that it will be an enjoyable one. Arizona has a lot of great opportunities for those who are wise enough to take advantage of them!

Published by HOLR Magazine.