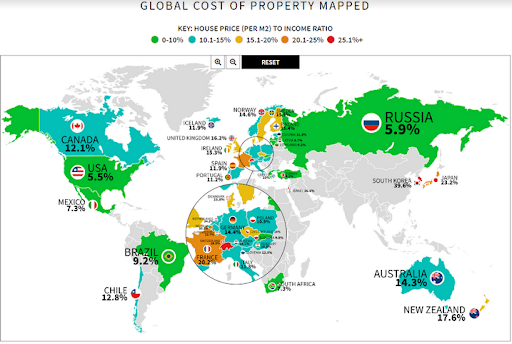

COVID-19 has caused property prices to boom in many countries around the world, making it more sensible for some homeowners to renovate rather than buy a new home. This is not the case everywhere, and if you happen to be in a country where homes are more affordable (see the graphic below by CTM to work out if that’s you), then this may not apply, but for the rest of us, here’s a few important pointers for making that renovation happen. Remember: Your dream renovation can still happen, even if you are experiencing hard financial times.

Planning Your Renovation

Before moving onto tips for financing your renovation, it is important to first discuss planning it. Foolishly, a lot of people rush into renovating their homes without giving the project its due diligence. You must plan, arrange, and organize every single detail before you even begin to think about financing it. Rushing into a renovation can be costly, and you can easily exceed your budget. You might also want to run your plans past a designer or architect to see whether or not they are viable in your home. You will also need to think about who will be doing the renovations. Will it be you or a construction team?

Taking a Loan from the Bank

One of the first things most people do when they want to renovate their home is to take out a loan from the bank. A bank loan does have its advantages. The process, provided that your credit is in order, is quite quick, and you can have access to the money in a matter of weeks. For some loans, you might need collateral, like your house for example, but we will come to that next. When searching for a bank loan, then you should find the one with the best interest rates. Shop around and do not make any rushed decisions.

Remortgaging Your Property

Instead of taking out a new loan, why not get a loan on your house? This is not always the best option, especially if you have nearly paid off your current mortgage. If you have poor credit, however, it might be your only option. Remortgaging your property comes with a lot of risks, so it is important to give it serious thought. If you cannot afford to pay back the loans, they will take your house, and all of your renovations will have been in vain. Speak to a financial planner before committing to a re-mortgage.

Government-backed Loans

There are certain government-backed loans that you may be able to apply for, provided that you meet their criteria. Government-backed home improvement loans will finance repairs and modifications. Most of these loans are available nationwide and not restricted to a single state. With that said, there are some loans solely available to residents of one state or even a county. The most popular is the HUD Title 1 Property Improvement Loan and the 203(k) Rehabilitation Mortgage Insurance Program, which allows homeowners to borrow up to $35,000 through their mortgage. You might also be able to apply for:

- Cash-out Refinance Loans for Veterans, as well as the Disabled Veterans Housing Assistance Loan;

- Rural residents may be able to apply for a rural grant or loan.

Borrowing from Friends or Family

Borrowing from friends or family is another common way that people finance their home renovations. Borrowing from friends or family allows you more leeway in terms of repaying your loan. It also means that your home will not be repossessed, nor will you have bailiffs turning up to take your belongings. You should be cautious when borrowing from loved ones, however. If you do not repay your loan according to your repayment schedule or on the date promised, you can ruin your relationships and damage them for life.

Cashing Out On Investments and Liquidating Assets

If you have any investment accounts that have accrued a lot of interest, then you might want to pull out of them to finance your home renovation project. By pulling out of your investment and drawing the cash, you save yourself the burden of borrowing or being in debt. Before cashing out, you might want to consult your bookkeeper or a financial planner to ensure that it is a sensible decision. Similarly, if you own a plot of woodland or a second house, then selling that can finance your project. Carefully think through liquidating assets, as by selling them, you could lose potential profits in the future. The same goes for your investments.

Financing your home renovation project post-COVID may be difficult, especially if you are out of work. You may even be able to put a little of your stimulus check aside each month if this is the case.